A good time for the evolution of mipymes

By: Patricia Olivares

Although they are small, the mipymes are the basis of the Mexican economy and the engine that sustains our country, providing a large number of jobs, goods, and services. Micro, small, and medium enterprises in Mexico are responsible for generating 72% of employment, contribute 52% to the national GDP, and represent 99.8% of the businesses– that is, 5.5 million companies providing jobs for 27 million people.

Within the framework of the Day of Micro, Small and Medium Enterprises (Mipymes), Erick Manuel Araiza Barrios, Head of Amextra Finanzas Internal Control Organ, tells us what this financial institution has done in support of mipymes and the family economy, during the height of the COVID-19 pandemic, the humanity continues to face, though with better conditions and prospects for the future; and what lessons they learned in this context about present and future entrepreneurship in our country.

Within the framework of the Day of Micro, Small and Medium Enterprises (Mipymes), Erick Manuel Araiza Barrios, Head of Amextra Finanzas Internal Control Organ, tells us what this financial institution has done in support of mipymes and the family economy, during the height of the COVID-19 pandemic, the humanity continues to face, though with better conditions and prospects for the future; and what lessons they learned in this context about present and future entrepreneurship in our country.

“During the COVID-19 pandemic, Amextra Finanzas did not stop at its task, we were an entity of society that did not shy away from responding to people’s specific needs in the midst of a context of uncertainty. First of all, we said, this is something we have to face, the government itself is clear that we are essential. If we close down and become hermetic, we are going to become part of the problem”.

So, the finance company continued its operations in support of hundreds of families who were already experiencing complex economic instability, that this issue soon made worse, while being consistent with one of its great postulates: “We work for those people who live poor, but are not. The conditions and the different situations of injustice and inequality present in this world have led them to live in poverty”.

Since 2010 Amextra Finanzas, as a Community Finance Company, has benefited around 29 thousand people from a middling economic situation to the lowest sectors, as it offers possibilities to those who have been excluded from the traditional financial system, namely, from commercial banks for not meeting the requirements.

“We provide opportunities through credit to the word to strengthen your ventures or businesses, with liquid resources in cash, so that they potentiate what already have, as enterprising individuals looking to participate in different markets and sectors. At the same time we mainly promote savings because we believe that it is the main way to generate true conditions of financial freedom. That’s why we want to be fair and responsible with making the money they place in our trust grow”.

“We provide opportunities through credit to the word to strengthen your ventures or businesses, with liquid resources in cash, so that they potentiate what already have, as enterprising individuals looking to participate in different markets and sectors. At the same time we mainly promote savings because we believe that it is the main way to generate true conditions of financial freedom. That’s why we want to be fair and responsible with making the money they place in our trust grow”.

Erick Araiza shares that, at the beginning of the pandemic, they thought that the savings were going to be massively withdrawn, but, on the contrary, they increased and continue to do so now. Therefore, the conservation, maintenance, and increase of savings is paramount and an indication that the people we serve are getting ahead and generating conditions of greater sustainability on their own.

“It is one of the things that we feel happy and proud of, because it tells us that we have been able to build a process of sustainability, of self-management of customers, in terms of covering their most basic needs, and thanks to their savings they have faced crises. It seems that our customers are on the right track with our philosophy, which is: change your way of thinking so that your way of life changes”.

During the pandemic, from May 2019 to July 2021, 1.2 million mipyme establishments were born, and 1.6 million closed their doors permanently. That is, more were closed than opened. And, although thousands emerged in the commercial and services area, 70% did not pass the first year, because “just as they are born, they die”, says Gerardo González Chávez, a researcher at the Institute of Economic Research of the UNAM.

Also, there was notable growth of transportation and food or product delivery companies, yet informally. This happened with a large sector of Amextra Finance customers, who were dedicated to catalog and food sales, but thanks to the financial support they were able to improve and expand their sales channels and gain better income opportunities. For example, One of her clients was selling food at a stand, but had to close; so her husband, who is a taxi driver, who doesn’t have much of a passage, joined the business chain for delivery.

“On the one hand, they became more solid businesses, because the family was more attached to the activity and they recovered their business. They even began to increase or strengthen family businesses or enterprises”.

“On the one hand, they became more solid businesses, because the family was more attached to the activity and they recovered their business. They even began to increase or strengthen family businesses or enterprises”.

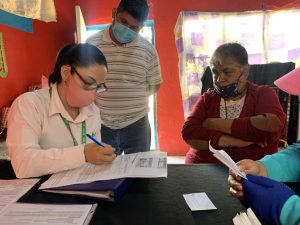

On the other hand, financial companies also faced great challenges and, in the cases of Amextra Finanzas, Erick Araiza explains that they modified their care methodology, because they operate mainly through solidarity groups that meet in the businesses or homes of the beneficiaries. With the pandemic, however they could no longer enter these spaces, which is why:

“We did it through the minimum possible contact, with a group of people going to the different branches. We started to promote more payment channels through the mobile applications that people have and through the different ATMs, which are found on the network”.

Also, they began to have several problems due to the non-payment of customers, especially since many of the businesses were cataloged within non-essential activities and had to close. So they tried mechanisms to restructure credits, lengthen terms and start paying again.

“And all this, in an atmosphere of uncertainty, once this situation was more under control we started to give workshops to our clients on how to improve or evolve to the new promotion methodologies,through selling on social network or home deliveries, which reactivated their activities and started a new demand in terms of credits and payment possibilities”:

Due to difficult process that we have lived through in Mexico due to the Covid-19 pandemic, great challenges have arisen for companies, financiers and entrepreneurs. One of them, according to Erick Araiza, is not having a dynamic economy, because there is not enough consumption and interchange; Therefore, each micro-business or company must be very creative in how to gain customers, promote its business, and sell. What will be essential to identify is its commercial differentiator, in order to have better chances of growth and existence in the future.

Due to difficult process that we have lived through in Mexico due to the Covid-19 pandemic, great challenges have arisen for companies, financiers and entrepreneurs. One of them, according to Erick Araiza, is not having a dynamic economy, because there is not enough consumption and interchange; Therefore, each micro-business or company must be very creative in how to gain customers, promote its business, and sell. What will be essential to identify is its commercial differentiator, in order to have better chances of growth and existence in the future.

Another challenge is that large companies took advantage of the pandemic to get involved in markets where small businesses were present on a day to day basis. “ Although digital literacy also has its benefits because it forced the use of technologies into sectors that had been slow to arrive, it removed from the market the people we work with. Now they have a smaller audience and market”.

Finally, Erick Araiza recommends that entrepreneurs expand their promotion, sales and payment channels, and thus accelerate the use of digital tools. By receiving and making digital transactions, they remain valid and have greater possibilities of making sales. Also, you have to think beyond traditional sales channels, and analyze the most immediate and real needs of the place they work.

“I think there is already a lot of saturation of the same products and services, which causes the market to be saturated, which makes the survival rate of businesses more complicated. We have to be receptive and look at what needs there are in the context, in the market, which no one else has covered or which is not being addressed optimally. We must seek to evolve towards these business opportunities and transform ourselves in terms of digital issues such as receiving payments, transactions and sales. I think it’s a good time to evolve in that sense”.

Thus, the indispensable factors for any entrepreneur are: to analyze the real need of the environment, to be strategic and wise, make a good reading of the times and moments, and to start planning with research, so as not succumb to assumptions and despair.

“Being an entrepreneur or businessman in a time of uncertainty is heavy and is not for everyone, therefore, when someone launches into this odyssey, you have to keep in mind that it will cost a lot of effort, courage, determination, drive and strength. It is important to generate support networks that support us in all the tasks and adventures that we launch as businessmen, merchants, entrepreneurs. Thus, with effort and dedication we can have fertile land and good scenarios to get ahead”.

Strengthen your finances and ventures with Amextra Finanzas and evolve your business to face the challenges of the present and future. Contact us here!

© 2023 Amextra, Asociación Mexicana de Transformación Rural y Urbana A.C. Todos los derechos reservados, México 2017-2023.

Leave a Reply